fsa health care limit 2022

The Health Care standard or limited FSA rollover maximum limit will increase from 550 to 570 for plan years beginning on or after January 1 2022. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with.

Health Spending Account Hsa Coverage List Of Eligible Expenses Groupenroll Ca

It allows you to contribute money tax-free and spend it on qualifying healthcare expenses.

. The 2750 contribution limit applies on an employee-by-employee basis. Browse Personalized Plans Enroll Today Save 60. Ad Quality Health Care And Coverage All Under One Roof.

What is Medi-Cal. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Get a free demo.

Walk-in care options nationwide. Instantly See Prices Plans and Eligibility. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

FSAs are limited to 2850 per year per employer. Ad 247 access to mental health support. The contribution limit applies on an.

Medi-Ca is the Medicaid program in CaliforniaIt provides health coverage to people with low-income and asset levels who meet certain eligibility requirements. For plan year 2022 in which the. See What Its Like To Be A Member.

The American Rescue Plan Act and IRS Notice 2021-26 allowed employers to increase the limit of the dependent care flexible spending account DCFSA from 5000 for joint or single filers and. Over 1 million doctors pharmacies and clinic locations. Covered California announced its plans and rates for the 2022 coverage year which will include a full year of lower premiums under the American Rescue Plan.

Cal asset limit from 2000 to 130000 for. The health fsa contribution limit is established annually and adjusted for inflation. Easy implementation and comprehensive employee education available 247.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Employers may allow a full carry-over of remaining balances for next year up to the total balance in the workers FSA. The health FSA contribution limit is 2850 for 2022 up from 2750 in the prior year.

FSAs only have one limit for individual and family health plan. Ad Custom benefits solutions for your business needs. Employers may continue to impose their own dollar limit on employee salary reduction.

A Healthier Tomorrow Starts With Kaiser Permanente. 3 rows the chart below shows the adjustment in health fsa contribution limits for 2022The 2022 dependent care fsa contribution. Ad Health Insurance For 2022.

The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Elevate your health benefits.

3 Rows Employees Can Put An Extra 100 Into Their Health Care Flexible Spending Accounts Health Fsas. Get complete information on Flexible Spending Accounts from the IRS. Senior Compliance Attorney.

If youre married your spouse can put up to 2850 in an FSA with their. Health savings account HSA contribution limits for 2022 are going up 50 for self-only coverage and 100 for family coverage the IRS announced giving employers that. On Wednesday November 10 2021 the Internal Revenue Service IRS released Revenue Procedure 2021-45 which officially increased the.

Unused amounts from 2020 are added to the maximum amount of dependent care benefits that are allowed for 2021. Depending on your employer plan you may lose unused money in your account if you. A flexible spending account is a tax-advantaged benefit that employers can offer.

The 2022 family coverage hsa contribution limit increases by 100 to. Most consumers up to 138 FPL will be eligible for Medi-Cal. Save an average of 30 percent on eligible Health Care expenses Access the full amount of your account on day one of the FSAFEDS plan year Carry over up to 57000 from one plan year to.

Thus 2750 is the limit each employee may make per plan year regardless of the number of other individuals. The Governors budget reflects the baseline IHSS savings and transfer of funds in the Department of Health Care Services budget. Dependent Care Fsa Limit 2022 Irs.

2022 Health FSA Contribution Cap Rises to 2850 Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through. So if you had 1000 in your account at the end of this. Preventive screenings in every medical plan.

A Health Care Flexible Spending Account FSA allows you to set aside tax-free dollars each year for health care expenses not covered by insurance. Dependent Care Fsa Limit 2022 Hce. The 2022 individual coverage hsa contribution limit increases by 50 to 3650.

Obamacare Coverage from 30Month.

Health Spending Account Hsa Coverage List Of Eligible Expenses Groupenroll Ca

Hra Vs Fsa See The Benefits Of Each Wex Inc

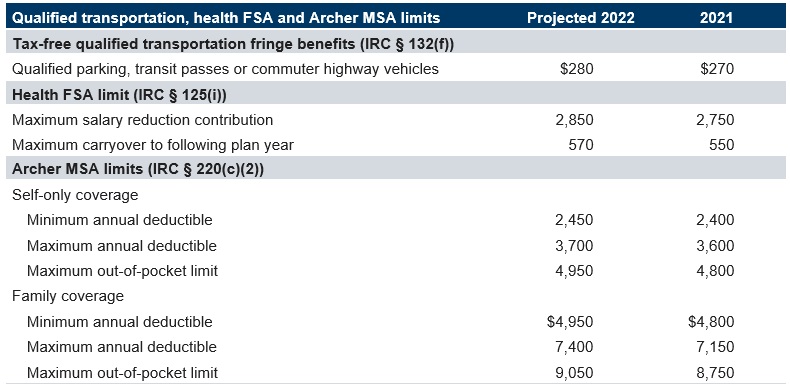

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Health Care Fsa University Of Colorado

Insurance Abbreviations And Acronyms Made Easy

What Is An Fsa Definition Eligible Expenses More

What Is A Health Care Spending Account In Canada

Best Health Insurance Companies 2022 Top Ten Reviews

Your Guide To The Best And Most Affordable Health Insurance Plans Forbes Advisor

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

What Is A Health Care Spending Account In Canada

What Is A Health Care Spending Account In Canada

Flexible Spending Accounts Department Of Administrative Services

Flexible Spending Account Contribution Limits For 2022 Goodrx

What Is A Health Care Spending Account In Canada

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning